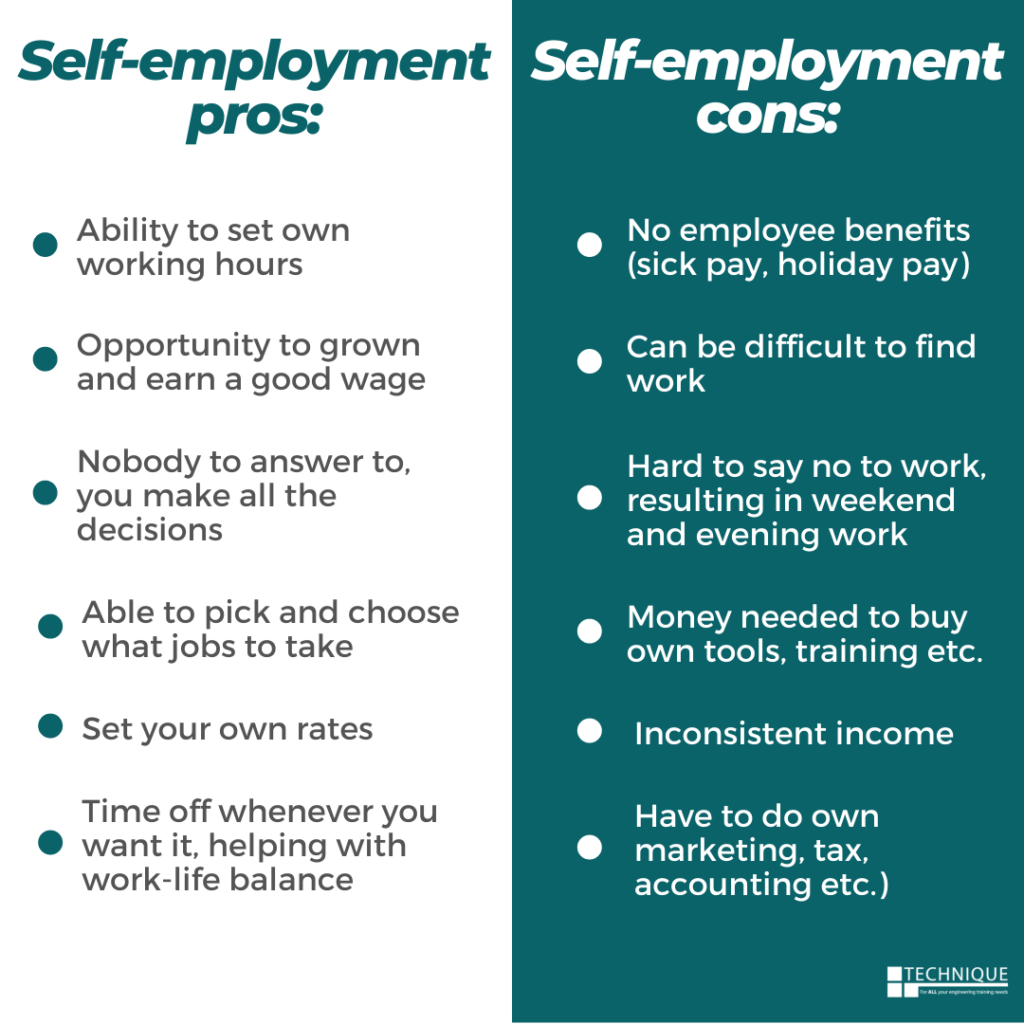

A huge decision for many people working within the trades industry is deciding whether to become a self-employed electrician or to go and work for an existing company. There are pros and cons to both roles, which is why this decision can be such a difficult one to make.

In this post, we will discuss the pros and cons of being self-employed, hopefully helping you to decide what the best option is for you, whether you’re new to the industry and trying to figure out how to get started, or already working in the industry and want to make a change.

Advantages of becoming a self-employed electrician

Many of the trades industry are self-employed including electricians, painters and decorators, plumbers, and more. Out of all the trades, self-employed electricians have the opportunity to earn the most with some earning up to £51,000 a year.

There are many advantages to going self-employed, the most attractive one being the freedom to be your own boss. Many electricians and other trades decide to go self-employed as it means they do not have to answer to anybody and can set their own hours, meaning you can start work at 11am if you wish, or finish at 2pm (although this rarely happens!) Those who are already in the industry often decide to go self-employed to fit their work around their family, rather than the other way round.

Being self-employed also means you can set your own pay rate, and receive 100% of the income (although some will need to go back into the business.) The average day rate can range from £170-340 per day, depending on experience level and specialisms.

When you are your own boss, you can also pick what jobs you do. Most of the time, you’ll take what you can get, but if you have a lot of work and can afford to turn jobs down, it’s a great way to focus on what you enjoy doing, what pays the most, or even something different to keep work interesting rather than doing the same jobs each day.

Disadvantages of becoming a self-employed electrician

There are some elements of being self-employed which don’t suit everybody, one of the main turn-offs being the inconsistency of earnings and the pressure. When working for a company, you get jobs given to you but when self-employed it’s down to you to find customers and work which can be difficult for some and some months may be quieter. Finding jobs can also bring a lot of extra pressure on top of other responsibilities like marketing and taxes.

There are costs involved in setting up your own business which can add up. You’re responsible for buying your tools, insurance, a van/car etc. These costs continue throughout your career, not just when starting up – as the business owner, you’ll be responsible for replacing and buying new equipment, covering costs of training when a refresh or new training is required, and other continuous costs like tax, insurance, wages etc.

Although the flexibility of being self-employed is appealing and seems like a good way to achieve a better work-life balance, this usually isn’t the case – due to the extra responsibilities and pressure for finding work, it can be difficult to switch off and turn work down, often resulting in working longer hours including evenings and weekends. Although you technically can take holidays whenever you like, you won’t get the usual employee benefits like holiday and sick pay, so any days off will result in no pay – those who want to succeed and earn money tend to work every day for many hours, usually resulting in a worse work/life balance.

Things to consider

There is a lot that goes into going self-employed, but there are a few important things to consider when first getting started.

- Have the right qualifications

All electricians need to be trained and qualified to carry out work, but when self-employed it’s important to ensure you have all the required qualifications, as well as extra ones as this will allow you to offer more services and gain more work and income. It’s also important to ensure these qualifications are industry recognised and awarded by City & Guilds or EAL. - Decide whether you want to be a sole trader or a limited company

Once a decision about whether to go self-employed has been made, the next big decision is whether to become a sole trader or a limited company. A sole trader means you will be the exclusive owner of your business, entitled to all profits after tax but also liable for any losses. As a limited company, your business has its own legal identity, separate from its owners and its managers – this has the benefit of having limited liability, so if something went wrong your personal assets aren’t exposed. - Join a competent person scheme

When self-employed, some work is required to be ‘notified’ under the Building Regulations, this means you will need to notify the local authority before the work is started. However, if you join a competent person scheme you can self-certify work through the scheme operator, meaning you will not need to notify the local authority. This is just one of many benefits of joining a scheme! - Sort tax and insurance

There are a range of legal tasks that need sorting out when becoming self-employed. Firstly, you need to make sure you’re registered with HMRC, you will need to file an annual Self Assessment tax return form – you can either do this yourself or hire an accountant. You also need to consider insurance to protect your assets and business, there are a range of covers that should be considered, public liability insurance, employers’ liability insurance and tool cover being the main ones. - Be prepared to work a lot

People tend to think being your own boss means you can work whenever you want, however, this is rarely the case. Ask any self-employed person and they will be able to tell you how much they work! Whether it’s practical work, answering emails, sorting accounts etc., there will always be something to do. Those who want their business to succeed and earn a good income will work for it.

If you have decided you want to take the plunge and become a sole trader or require further information before deciding whether this is the best option for you, we have an expert guide that discusses everything you need to know about becoming a self-employed electrician! If you would like a FREE copy of this expert guide, simply fill in your details below and we can send you the download link.